Have you ever found yourself juggling multiple debts and struggling to keep track of payments? Or perhaps you’re wondering how to fund a large purchase or cover an unexpected expense without disrupting your finances. If so, personal credit might be the answer you’re looking for. But how exactly can these loans simplify your financial situation?

Understanding the Basics of Personal Credit

Personal loans are a type of unsecured loan, which means you don’t need to provide collateral like a home or car. It’s a flexible way to borrow money for various purposes such as consolidating debt, covering medical bills, or even financing a large purchase. The beauty of these loans lies in their simplicity—they are typically offered with fixed interest rates and set repayment terms, making it easy to plan your finances.

For many, personal credits are an attractive alternative to credit cards or payday loans, which can carry high interest rates. With personal credit, you can often secure a lower interest rate and a fixed repayment schedule, meaning you’ll know exactly how much you owe each month.

Debt Consolidation Made Easy

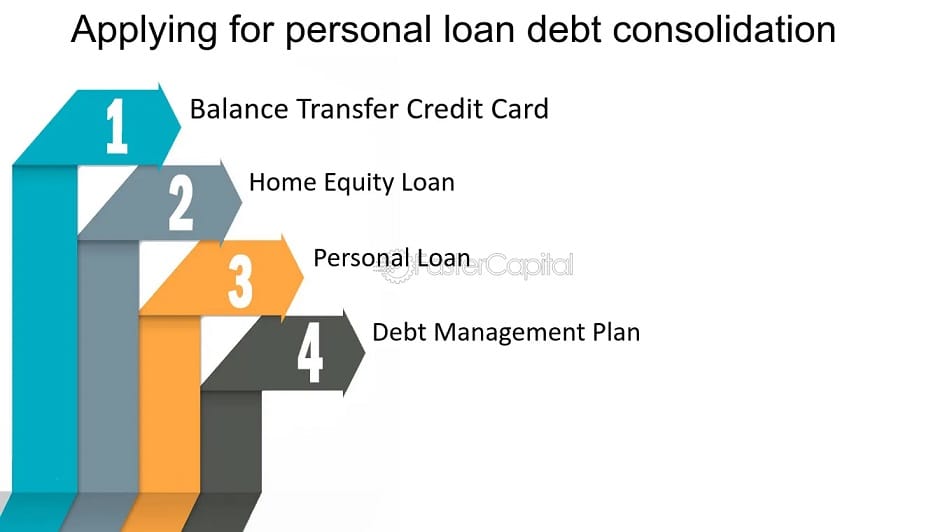

One of the most common reasons people take out personal financing is to consolidate their debt. Do you have multiple credit card balances or loans scattered across different accounts? Managing these payments can be overwhelming and costly. By taking out a personal credit, you can combine all your debts into one monthly payment.

This method can assist you in reducing the amount spent on interest fees. Instead of paying high rates on credit cards or short-term loans, you could secure a more competitive rate with a personal credit. This makes it easier to manage your finances and pay off your debt quicker, without the stress of juggling multiple bills.

Improving Cash Flow for Big Purchases

Another way personal credit can simplify your finances is by providing the cash flow you need for big-ticket items. Whether it’s a home renovation, a wedding, or a dream holiday, sometimes it’s not feasible to cover these expenses all at once. Instead of depleting your savings or resorting to high-interest credit cards, you can opt for personal credit.

Personal financing often comes with fixed repayment terms, which means you can plan ahead and spread the cost of your purchase over time. With predictable payments and lower interest rates, it becomes much easier to manage your finances without the sudden shock of a large expense.

Building Your Credit Score

If you’ve been struggling with your credit rating, a well-managed loan could be an effective way to boost it. How does this work? When you take out a loan and make regular payments on time, you demonstrate responsible borrowing habits. This, in turn, can positively affect your credit history and score.

It’s important to note that simply applying for a loan won’t improve your credit score—how you manage the loan will. By ensuring timely payments and not over-extending yourself, you’ll slowly build a stronger financial reputation, which could benefit you in the long run.

Managing Unexpected Expenses with Ease

Life is brimming with unexpected events, and occasionally, these events come at a high cost. Whether it’s an emergency medical bill or an urgent car repair, unexpected expenses can throw your finances off track. In these situations, personal credit can offer a safety net.

Instead of resorting to expensive short-term options, personal credit can provide the funds you need at a reasonable interest rate. It offers quick access to cash, allowing you to address the immediate issue without having to sacrifice your financial stability.

Personal loans offer more than just a way to borrow money—they can be a strategic tool for simplifying your finances. If you’re looking for a straightforward way to improve your cash flow, consolidate debt, or tackle a large purchase, consider the benefits of personal financing. The right approach could be the key to simplifying your financial life.